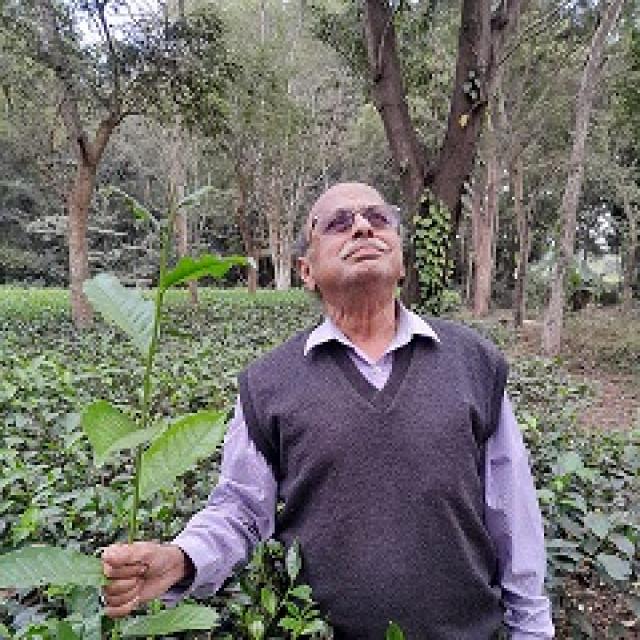

Dr. Bijoy Chandra Ghosh

Advisor & Technical Head

Dr. Bijoy Chandra Ghosh

A retired Professor from Agricultural and Food Engineering Department, Indian Institute of Technology (IIT), Kharagpur, with a long career of research in the academic field of agriculture.

His contributions in the areas of organic farming, organic food production, vermicompost technologies, tea cultivation, roof top technologies and crop diversification have had impact in the world of agriculture. He has carried out a large number of research projects in the entirely of his academic career. In his credit, number of research papers has been published in both national and international journals. He has supervised 18 Ph.D. students. He has visited many countries, in order to both gain and share knowledge, and has significant experience and expertise in the field of agriculture.

Shri Gora Chand Roy Choudhury

Chairman

Shri Gora Chand Roy Choudhury

Practising lawyer of High Court, Calcutta. Received appreciation from Consulate General of Japan for legal assistance. Had been appearing for Ministry of Environment Forest and Climate Change (MOEF & CC). GOI as Central Government Counsel for 12 states of Eastern Zone and one Union Territory for years together. Had been appearing as Legal Counsel for State Environment Impact Assessment Authority (SEIAA), Odisha. Had been appearing as Legal Counsel for Life Insurance Corporation of India. Had been appearing as Legal Counsel for ICFRE (Indian Council of Forestry Research and Education).

Counsel representing AIR INDIA, National Insurance Company, Governing Body member of Behala Balananda Bramhachari Hospital & Research Center, Trustee member of ARYA SAMITI, Behala.

Shri Sankarsan Dutta

CEO & CFO

Shri Sankarsan Dutta

Credit Officer (IBPS Batch 2), Bank of Baroda (2013-2020)

Specialist in Tea Garden & Iron Industry.Reviewed credit applications and financial statements to determine customer creditworthiness.Analyzed customer accounts, payment trends, and credit ratings to assess risk of default. Conducted regular reviews of existing customers' accounts to ensure compliance with agreed terms. Developed policies and procedures for approving and managing customer credit limits. Assessed the impact of new products or services on current credit policies. Monitored customer account activity to identify any potential risks or issues. Provided guidance and advice on credit management practices to internal stakeholders. Maintained accurate records of all customer interactions including notes on conversations and decisions made.Coordinated with legal teams when necessary to ensure compliance with applicable laws and regulations. Prepared industry specific detailed reports summarizing customer profiles, risk assessments, and recommendations for approval and denial of new lines of credit.